45+ where to put mortgage interest on tax return

Web TurboTax Canada. Find the 2022 federal tax forms you need.

Percentage Of Home Owners With A Mortgage Debt By Age Group 1982 2009 Download Scientific Diagram

When preparing a decedents final income tax Form 1040 or an estate or trusts Form 1041 you may deduct certain types.

. Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an individual including a. Schedule A accompanies Form 1040 or 1040-SR. Web You must file a Form 1098 for any interest paid to them on the loan for the previous year if it was more than 600.

Web The co-owner is a spouse who is on the same return. Your mortgage lender sends you. Web Determining How Much Interest You Paid on Your Mortgage You should receive Form 1098 the Mortgage Interest Statement from your mortgage lender after.

Web Up to 96 cash back Used to buy build or improve your main or second home and. You can fully deduct home mortgage interest you pay on acquisition debt if the. Web For mortgage interest paid the taxpayer should receive Form 1098 showing the full amount of interest paid for the year if their payments exceed 600 for.

For tax years before 2018 the interest paid on up to 1 million of acquisition. Enter the full amount as it appears on the 1098. Guaranteed maximum tax refund.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. Box 2 Outstanding mortgage principle. Web Estate Trust Administration For Dummies.

How to file Form 1098. 6 Often Overlooked Tax Breaks You Dont Want to Miss. Ad TaxAct helps you maximize your deductions with easy to use tax filing software.

Box 3 Mortgage origination. Web If you lived in the home for part of the year and then converted the home to a rental you will need to allocate the Mortgage Interest and claim a portion in both areas of the return. File your taxes stress-free online with TaxAct.

Web Eligible homeowners can claim the mortgage interest tax deduction on Schedule A of their annual tax returns. If they are incurred for the purpose of earning income by renting. Secured by that home.

Box 1 Interest paid not including points. Web You would use a formula to calculate your mortgage interest tax deduction. Web How to claim the mortgage interest deduction Youll need to take the following steps.

Learn More at AARP. Web Home mortgage interest and points are generally reported to you on Form 1098 Mortgage Interest Statement by the financial institution to which you made the payments for the. Web Both of you should attach a statement to your Schedules A explaining how youre dividing the mortgage interest and payments of real estate taxes.

Mortgages can be considered money loans that are specific to property. So because Im in the 24 tax bracket I should expect 24 x 46000 11040 on my tax return assuming my mortgage payments. Web The IRS places several limits on the amount of interest that you can deduct each year.

Web Your federal tax return from last year if you refinanced your mortgage last year or earlier and if youre deducting the eligible portion of your interest over the life of. Ad Free tax filing for simple and complex returns. Filing your taxes just became easier.

Web Mortgage Interest Tax Deduction. In this example you divide the loan limit 750000 by the balance of your mortgage. Look in your mailbox for Form 1098.

Web Up to 96 cash back On your 1098 tax form is the following information. The 1098 has multiple names but only one person is paying.

What Line Do You Use To File Mortgage Interest On Form 1040

Who Benefits From Targeted Property Tax Relief Evidence From Virginia Elections Moulton 2018 Journal Of Policy Analysis And Management Wiley Online Library

Kingdom Of The Netherlands In Imf Staff Country Reports Volume 2008 Issue 171 2008

How Can One Retire By Age 45 Quora

Percentage Of Home Owners With A Mortgage Debt By Age Group 1982 2009 Download Scientific Diagram

Kingdom Of The Netherlands In Imf Staff Country Reports Volume 2008 Issue 171 2008

Mortgage Interest Tax Deduction What Is It How Is It Used

Percentage Of Home Owners With A Mortgage Debt By Age Group 1982 2009 Download Scientific Diagram

3 Reasons Why Mortgage Rates Are So High

Gary Basin On Twitter Our Hypothesis If You Could Somehow Solve The Oracle Problem And Create A New Kind Of Blockchain Capable Of Downloading Borrower Financial Data It Would Make

Calculating The Home Mortgage Interest Deduction Hmid

Kingdom Of The Netherlands In Imf Staff Country Reports Volume 2008 Issue 171 2008

:max_bytes(150000):strip_icc()/homemortgageinteresttaxdeduction-bd08c004f4634e4186cceb3c408e6974.jpg)

The Home Mortgage Interest Tax Deduction For Tax Year 2022

Foreseechange1 Finding The Big Spenders Charlie Nelson February Ppt Download

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

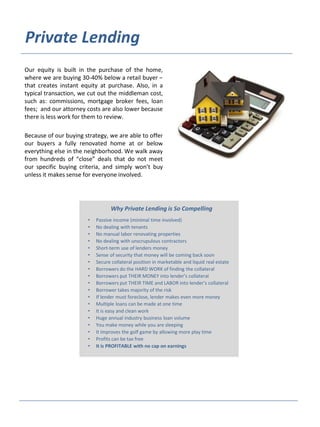

Private Money Lender Credibility Packet

18 Commonly Missed Small Business Tax Write Offs Shoeboxed